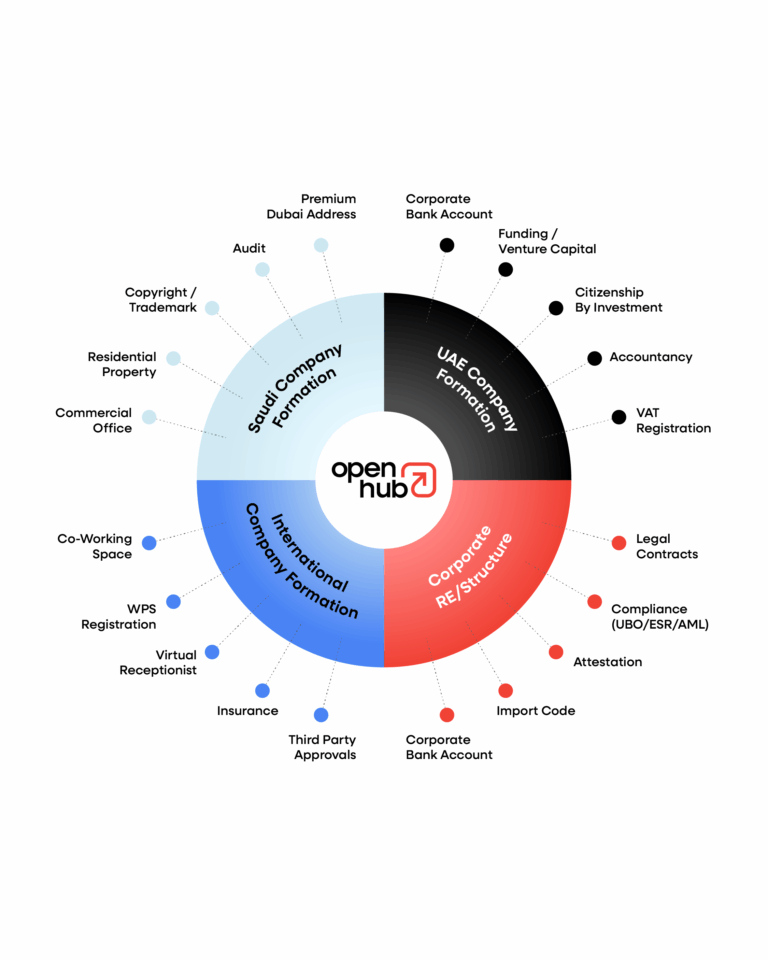

Services

Smart Solutions for Seamless Growth

Corporate Services

Beyond the initial stages of business setup, we offer a wide range of support services so you can stay focused on what matters.

Freezone Trade License

Let our industry specialists assist you in selecting and setting up a business in a suitable Free Zone that meets your company's needs.

Mainland trade license

Complete your mainland company formation in one of the Emirates with full access to a broad range of business activities and locations available.

Golden Visa

You can unlock a world of opportunity with the UAE Golden Visa. It is the perfect solution for individuals and families looking for a safe and secure way to live and work in the UAE without a sponsor.

Accounting Services

Let our industry specialists assist you in selecting and setting up a business in a suitable Free Zone that meets your company's needs.

PRO Services

We offer a comprehensive range of PRO services designed to help you streamline your operations and ensure compliance with local laws and regulations.

Corporate Bank Account

We specialise in assisting businesses with corporate bank account set up, ensuring a seamless process from start to finish.

VAT Registration

VAT Registration is a mandatory requirement in the UAE once certain financial thresholds are met.

Legal Contracts

Our legal experts will prepare shareholder and client partnership agreements.

Import Code

Our team of professionals are familiar with the local laws and rules needed to apply for an import code. We know how crucial it is for a business to send and receive goods in a timely manner.

UAE Compliance

The regulatory requirements for enterprises in the UAE, such as the ESR, UBO and AML.

Attestation

Our in house attestation service will assist you in verifying company and personal documents, from governing bodies around the world.

WPS Registration

A mandatory requirement in the UAE for mainland companies and select Free Zone companies to pay their employees.

Insurance

Providing medical insurance to your employees is a mandatory requirement in most UAE jurisdictions. Let us get you the best rates with our industry partners.

Third-Party Approvals

Certain business activities require third party approvals from specialised UAE governing bodies and governmental departments.

Commercial Office

Open Hub is a strategic partner with CRC, a leading commercial real estate company that helps new businesses rent or buy offices and retail spaces.

Virtual Receiptionist

Need a professional receptionist to take your calls, book appointments and relay the messages via email instantly?

Co-working Space

The ever changing digital landscape has made connectivity more accessible for everyone.

Audit

Provide credibility to your financial accounts and give shareholders, clients and potential investors confidence that your accounts are true and fair.

Residential Property

We also help business owners and employees find, rent & buy residential properties through our commercial partnership with Betterhomes.

Copyright / Trademark

Protect your brand, intellectual property and identity through global copyright and trademark services

Premium Dubai Address

Add credibility to your company with our hand picked Dubai premium addresses and mail management services.

Venture Capital / Investment

We have partnered with a number of investment platforms and provide venture capital opportunities to help you expand and reach your financial goals.

Citizenship by Investment

In a world where global mobility is more important than ever, second residency and citizenship offer you the freedom to build your life without boundaries

Freezone Trade License

Let our industry specialists assist you in selecting and setting up a business in a suitable Free Zone that meets your company's needs.

Mainland trade license

Complete your mainland company formation in one of the Emirates with full access to a broad range of business activities and locations available.

Golden Visa

You can unlock a world of opportunity with the UAE Golden Visa. It is the perfect solution for individuals and families looking for a safe and secure way to live and work in the UAE without a sponsor.

Accounting Services

Let our industry specialists assist you in selecting and setting up a business in a suitable Free Zone that meets your company's needs.

VAT Registration

VAT Registration is a mandatory requirement in the UAE once certain financial thresholds are met.

Corporate Bank Account

We specialise in assisting businesses with corporate bank account set up, ensuring a seamless process from start to finish.

Business Setup & Licensing

Financial, Legal & Compliance

Residency & Employee Welfare

Operational & Growth Support

- Mainland Trade License

- Freezone Trade License

- PRO Services

- Third Party Approvals

- VAT Registration

- Business Bank Account

- Legal Contracts

- Insurance

- Corporate Tax

- WPS Registration

- Residency Investment

- Residential Property

- Golden Visa

- Premium Dubai Address

- Virtual Receptionist

- Venture Capital

- Accounting Services