- 🇦🇪 Free Zone License 🇦🇪 Free Zone License 🇦🇪

- 🇦🇪 Free Zone License 🇦🇪 Free Zone License 🇦🇪

- 🇦🇪 Free Zone License 🇦🇪 Free Zone License 🇦🇪

- 🇦🇪 Free Zone License 🇦🇪 Free Zone License 🇦🇪

- 🇦🇪 Free Zone License 🇦🇪 Free Zone License 🇦🇪

- 🇦🇪 Free Zone License 🇦🇪 Free Zone License 🇦🇪

- 🇦🇪 Free Zone License 🇦🇪 Free Zone License 🇦🇪

- 🇦🇪 Free Zone License 🇦🇪 Free Zone License 🇦🇪

UAE Free Zone License

Starting a UAE business? Get the right license and plan your next 1-5 years with our setup experts.

UAE Free Zone Advantages:

1. 100% foreign ownership available

The key benefit of operating in a UAE Free Zone is that foreign investors can continue to own 100% of their companies on all available business activities.

2. Benefit from sector-specific opportunities.

The fact that many of the UAE's Free Zones are sector-specific can also offer tremendous opportunities to enterprises operating in Free Zones.

3. Enjoy 0% income tax and no import/export duties

Financial benefits of Free Zones include an income tax rate of 0%, the potential absence of import and export-related customs taxes, and the possibility to repatriate 100% of the company's revenues via qualifying business activities.

4. Flexible office solutions – operate without a traditional office

Free Zones allow businesses to operate without needing a corporate office, depending on the company's nature. Many Free Zones in the UAE offer SMEs to work in flexible office spaces and the exemption to lease or own office space.

5. Fast License Issuance

Set up your business in 1-3 working days. Online & remote.

Our Partner Free Zones in the UAE

Dubai Multi Commodities Centre (DMCC)

The Dubai Multi Commodities Centre (DMCC) was founded in 2002 as a strategic initiative of the Dubai government with the mission of providing the physical, market, and financial infrastructure necessary to set up and maintain a vibrant commodities marketplace. With over 14,100 registered enterprises, DMCC is now officially recognized as the biggest Free Zone in the United Arab Emirates.

DMCC strives to promote Dubai as a commercial gateway, assisting the government in achieving long-term economic growth. Its highly integrated marketplace is critical to the Free Zone’s existing and rising firms. As a new enterprise, DMCC is the ideal Free Zone in which to develop.

Key Benefits

100% foreign ownership permitted

Prime central geographical location

Wide variety of office solutions for every PSQFT budget

A comprehensive selection of trading and consultancy business activities

Fewer restrictions on sensitive nationalities

Open Hub’s Outlook

DMCC is a recognised global hub for international trade and commerce. DMCC has the ability to accommodate entry-level startups and provide avenues for their expansion with a large supply of office space for every budget.

Caters to a wide range of consultancy and trading business activities across various sectors.

Well situated in the heart of Dubai with excellent transport links and connectivity for shareholders, employees and clients.

Transparent freezone with public register and mandatory audited accounts for client and investment piece of mind.

Dubai International Financial Centre (DIFC)

The Dubai International Financial Centre (DIFC) is a 272-acre special economic zone in Dubai that opened in 2004 as a financial centre for corporations operating in the Middle East, Africa, and South Asia markets. The Dubai Financial Services Authority governs DIFC, an independent regulator unique to the zone, as well as its own judicial system, DIFC Courts, which is distinct from the legal systems of the Emirate of Dubai and the federal government of the UAE. The freezone houses financial institutions and wealth funds, as well as retail and hotel spaces.

Key Benefits

100% foreign ownership permitted

Autonomous regulatory and legal framework

Has its own independent legal and regulatory framework for all civil and commercial matters practising UK common law

Exclusive financial business activities

Public registry

Ultra prime office space available

Open Hub’s Outlook

A sophisticated, free zone and globally recognised as one of the most premium jurisdictions for conducting financial activity. Highly regulated for clients’ peace of mind, which in turn opens gateways for corporate investment opportunities.

Unlocks the ability to operate your company from some of the most prime commercial offices in the region to entertain clients.

Provides access to exclusive regulated commercial, financial activities

Meydan Free Zone (MFZ)

Established in February 2009, Meydan Free Zone (MFZ) provides an efficient and smooth business environment for start-ups at one of Dubai’s best and most renowned locales.

Meydan Free Zone provides a highly cost-effective option for establishing a business, as well as full free zones benefits such as 100% ownership, no taxation, no currency restrictions, the ability to hire foreign labour, no duty tax on import and export, and flexi desk options, which are extremely convenient for those who do not need a permanent physical office for their business.

The Meydan development also comprises a variety of commercial complexes, sports centers, hotels, entertainment stations, and a number of cutting-edge facilities.

Key Benefits

100% foreign ownership permitted

24-hour licence issuance

Dual mainland license/permit available for select activities

Shareholder physical presence is not necessary; remote company formation

No NOC is required from the present visa sponsor

Physical office space is not mandatory

Open Hub’s Outlook

Cost-effective prime Dubai jurisdiction. Meydan reduces the high-cost mandatory office space barrier to entry by providing virtual office and business centre solutions for their clients.

Meydan is one of the only Dubai-free zones that allow you to extend your company’s operation onto the mainland with their exclusive permits for selected activities.

International Free Zone Authority (IFZA)

International Free Zone Authority (IFZA) is a free zone in Dubai that is co-branded with Dubai Silicon Oasis Authority. IFZA provides the most affordable options for establishing a Dubai free zone firm. The International Free Zone Authority (IFZA) provides companies with more than just a free zone; they are a community that allows entrepreneurs and enterprises to become part of an ever-evolving ecosystem in one of the world’s most forward-thinking cities.

To maximize business formation in Dubai, they utilize their strategic position and combine it with the highest levels of expertise, customer-oriented service, and regulatory understanding.

Key Benefits

Professional, commercial, and industrial business activities can all be merged under a single IFZA License.

Shareholder physical presence is not necessary; remote company formation

Fast and efficient processes

No NOC is required from the present visa sponsor

Physical office space is not mandatory

Open Hub’s Outlook

Cost-effective prime Dubai jurisdiction. IFZA reduces the high-cost mandatory office space barrier to entry by providing virtual office and business centre solutions for their clients.

Offers a wide selection of trading and commercial business activities across various sectors.

Jebel Ali Free Zone Authority (JAFZA)

Jebel Ali Free Zone (Jafza) is a worldwide base for thousands of firms from over 100 countries, and it has earned a reputation as a commerce accelerator both locally and globally. The Free Zone alone accounts for 23.8 percent of Dubai’s overall GDP, making it one of the UAE’s fastest-expanding free zones. Jafza is a thriving business centre for the industrial and trade sectors.

The Free Zone is home to some of the world’s most successful firms. These businesses have selected Jafza as their regional headquarters, paving the path for global connection.

Key Benefits

Large commercial and industrial spaces are available

DLD permits the ability to own UAE real estate as a company

Internationally recognized jurisdiction

Open Hub’s Outlook

Home to the largest seaport between Singapore and Rotterdam and globally recognised as a regional hub for international trade.

Carries great import and export accessibility benefits to the UAE and wider regions.

Large plots of land are available for warehousing, industrial services and factories.

Dubai World Trade Centre Free Zone (DWTC)

For businesses seeking a competitive and well-regulated ecosystem in which to operate more successfully locally and worldwide, the DWTC Authority offers a unique and highly attractive opportunity. They provide a great environment for startups, SMEs, and major enterprises to function locally while reaching regional and worldwide markets since they are strategically located in Dubai’s Central Business District. The bulk of Dubai Department of Economic Development operations is represented by DWTC, ranging from commodities to retail establishments and consultancies to beauty salons.

Businesses in any field that require a world-class commercial location can lease office spaces, both collaborative and conventional. The Dubai World Trade Centre Authority administers the free zone and extends from the landmark Dubai World Trade Centre to the adjacent One Central.

Key Benefits

A comprehensive selection of trading and consultancy business activities

Fewer restrictions on sensitive nationalities

100% foreign ownership permitted

Prime central geographical location

Open Hub’s Outlook

Caters to a wide range of consultancy and trading business activities across various sectors.

Large selection of business centres to operate your company from if a physical office is not required.

Well situated in the heart of Dubai with excellent transport links and connectivity for shareholders, employees and clients.

Dubai Internet City Free Zone (DIC)

Dubai Internet City (DIC) is an information technology and business park established by the Government of Dubai as a free economic zone and strategic location for enterprises targeting rising regional markets. DIC offers about 1.5 million square feet of premium commercial office space, which is home to over 1,400 firms employing over 10,000 people. The DIC economic regulations allow enterprises to take advantage of a multitude of ownership, taxes, and customs-related benefits that are legally guaranteed for a period of 50 years.

One style of operation incorporates 100% foreign ownership, similar to that seen in the country’s other designated economic zones. These liberties have prompted numerous worldwide information technology corporations, including Facebook, LinkedIn, Google, Microsoft, and IBM, as well as UAE-based enterprises like Ducont, to relocate their regional headquarters to the DIC. DIC is near other industrial clusters, including Dubai Media City and Dubai Knowledge Park.

Key Benefits

100% foreign ownership

Prime location

Tech-focused ecosystem

Open Hub’s Outlook

A large Dubai jurisdiction with boutique business activities geared towards technology, innovation, internet, software, web 3.0.

Home to some of the largest global tech companies and regional headquarters for blue chip companies. Situated in the heart of Dubai, offering prime office locations.

Host regular events and networking opportunities for like-minded individuals under their jurisdiction umbrella.

Dubai Media City Free Zone (DMC)

Dubai Media City, which opened in 2001 with the goal of establishing Dubai as the region’s main media centre, presently houses over 2,000 local and regional media enterprises from 142 countries. Advertising, communications, event management, media advice, and support services, as well as a variety of freelancers, are all welcome in the free zone.

For the last 20 years, Dubai Media City has secured its place as the region’s most respectable media community that contains the largest global and local media companies. It is a community where freelancers, startups, SMEs, and major corporations coexist, contributing to Dubai’s designation as “Arab Media Capital 2020.”

Key Benefits

100% foreign ownership

Media focused ecosystem

Open Hub’s Outlook

A large Dubai jurisdiction with boutique business activities geared towards media, news and journalism.

Home to some of the largest global media companies and regional headquarters for blue chip companies. Situated in the heart of Dubai, offering prime office locations.

Host regular events and networking opportunities for like-minded individuals under their jurisdiction umbrella.

Dubai Design District (D3)

Dubai Design District (D3) was launched in 2013 by Sheikh Mohamed bin Rashid al Maktoum, the UAE’s Prime Minister and Ruler of Dubai, to support growth and investment in areas such as digital media, arts, design, and fashion. The free zone is appropriate for enterprises of all sizes and is home to both local and international fashion houses.

Along with office space and development property, the Dubai Design District Free Zone also provides studio space and co-working amenities, making it an appealing free zone for business establishments in the design and fashion sectors.

Key Benefits

100% foreign ownership

Strategic location

Fashion & Design focused ecosystem

Open Hub’s Outlook

A large Dubai jurisdiction with boutique business activities geared towards fashion, design and art.

Home to some of the largest global fashion brands and home to many of their regional headquarters.

New high-end offices.

Host regular events and networking opportunities for like-minded individuals under their jurisdiction umbrella.

Ras Al Khaimah Economic Zone

Dubai Design District (D3) was launched in 2013 by Sheikh Mohamed bin Rashid al Maktoum, the UAE’s Prime Minister and Ruler of Dubai, to support growth and investment in areas such as digital media, arts, design, and fashion. The free zone is appropriate for enterprises of all sizes and is home to both local and international fashion houses.

Along with office space and development property, the Dubai Design District Free Zone also provides studio space and co-working amenities, making it an appealing free zone for business establishments in the design and fashion sectors.

Key Benefits

Value for money

A comprehensive selection of trading and consultancy business activities.

Wide variety of office solutions for every PSQFT budget

100% foreign ownership

Open Hub’s Outlook

Cost effective alternative to Dubai freezones, offering a wide range of professional and commercial business activities. Good value rental options for commercial warehouses and offices..

Abu Dhabi Global Market (ADGM)

Abu Dhabi Global Market (ADGM), located on Al Maryah Island, is an award-winning worldwide financial centre comprised of three autonomous authorities: the Registration Authority (RA), the Financial Services Regulatory Authority (FSRA), and the ADGM Courts. ADGM provides exceptional service and opportunities for its business community to thrive by operating in accordance with international best practices through its transparent and pioneering regulatory frameworks, business-friendly operations, application of English Common Law and independent legal jurisdiction, and well-established local and international strategic partnerships.

ADGM is home to a broad selection of local and international businesses of all sizes, spread throughout a 114-hectare complex with world-class office space as well as cutting-edge recreational, entertainment, and hospitality amenities.

Key Benefits

- The legal framework supports cross-border activities

- 100% foreign ownership permitted

- Independent, English-speaking, common law judicial system

- Autonomous regulatory and legal framework

- Exclusive financial business activities

- Public registry

Open Hub’s Outlook

A sophisticated, free zone and globally recognised as one of the most premium jurisdictions for conducting financial activity. Highly regulated for clients’ peace of mind, which in turn opens gateways for corporate investment opportunities.

Khalifa Industrial Zone Abu Dhabi (KIZAD)

The Khalifa Industrial Zone Abu Dhabi (KIZAD) is one of the region’s largest integrated commercial and industrial zones, linked to the Khalifa Port, and attracts worldwide enterprises specializing in transportation, distribution, manufacturing, trading, and storage. KIZAD provides easy alternatives and a flexible environment for creating new businesses, with access to regional and worldwide markets, a diverse selection of start-up solutions, high-quality infrastructure, and good road and transit networks. It also features high-quality warehouses with conveniently accessible truck-loading docks, as well as other leasing spaces.

The Khalifa Industrial Zone (KIZAD) has world-class transportation facilities that support the commercial, industrial, and logistical industries in the United Arab Emirates’ capital, Abu Dhabi. KIZAD provides investors with flexible ownership rights as well as land intended for industrial and logistical firms.

Key Benefits

- Physical office not required

- 5 linked activities per license

Open Hub’s Outlook

- KIZAD specialises in industrial, logistics and trading activities. Strategically situated halfway between Dubai and Abu Dhabi.

- KIZAD will benefit the most out of all free zones from the upcoming UAE rail system with direct connections.

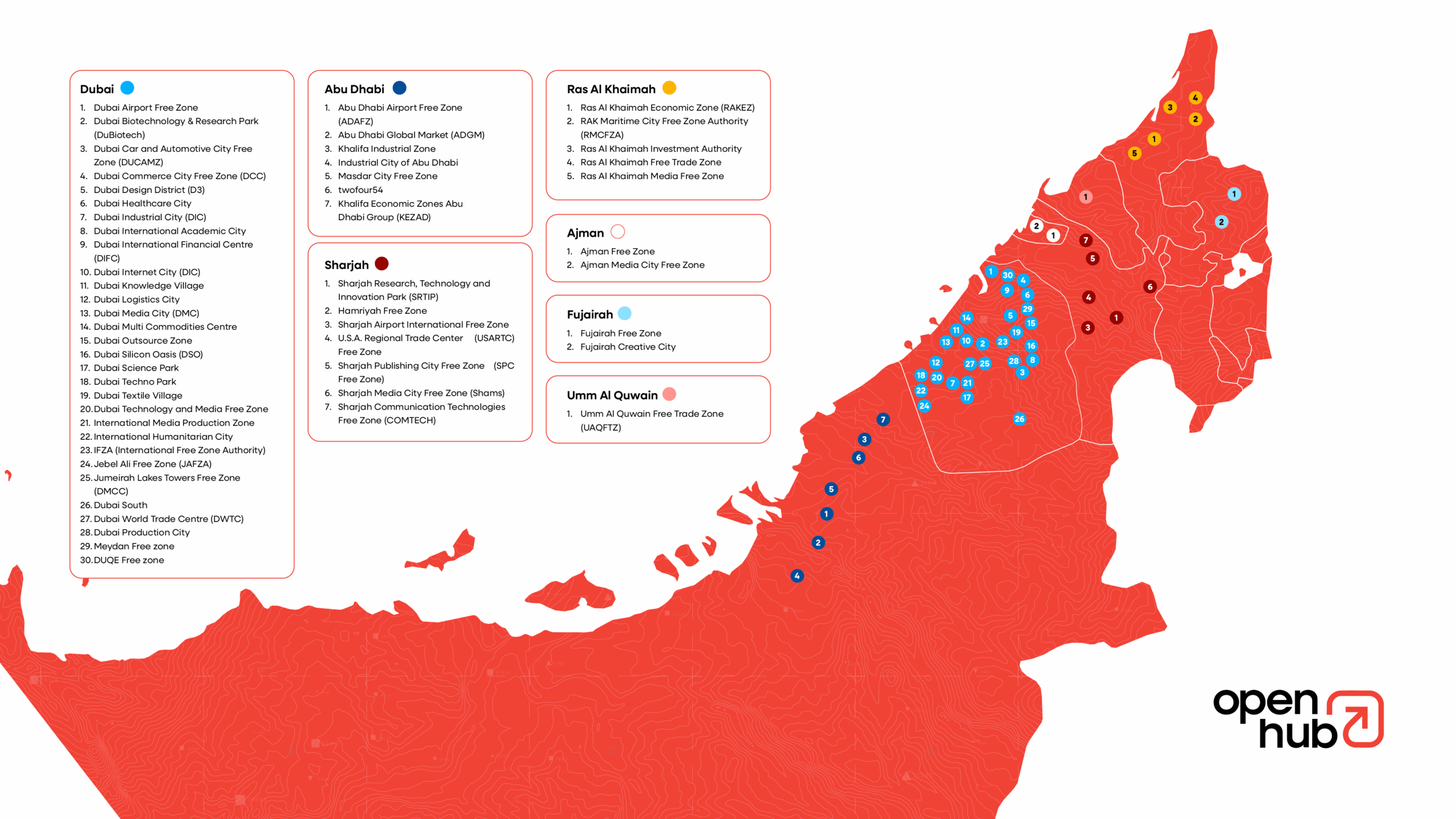

Freezones Map

Testimonials

What our clients say

Trustindex verifies that the original source of the review is Google. Moving to Dubai and setting up a new company can be very stressful however Michael Fletcher made the process seamless and stress free. I would recommend Open Hub to anyone thinking of setting up a company in DubaiPosted onTrustindex verifies that the original source of the review is Google. Special thanks to Scott & Dominic at OpenHub who helped me to set up a trade license for a new company. They were both super informative and guided me through the whole process smoothly and efficientlyPosted onTrustindex verifies that the original source of the review is Google. OpenHub was professional, offered the best pricing, and even included some complimentary services within our scope of work. Their team are knowledgeable, decent people, competent, and they got the job done well. Our situation required a fast company setup in the UAE. Unfortunately there were delays and additional steps - all of which were beyond their control and just part of the process. At the time I would've appreciated clearer communication about the changes and the overall timeline. However, OpenHub handled each step promptly and provided extra VIP services that helped accelerate the process. Overall we got the job done in time and I'm thankful for the additional care we received during these delays. OpenHub is a solid choice for setting up a business in the UAE. I appreciate their support and look forward to working together in the future. Thanks Michael, Dominic, Gene and the rest of the team behind the scenes!Posted onTrustindex verifies that the original source of the review is Google. OpenHub has been the most seamless and accommodating business setup service I’ve experienced in Dubai. From trade license registration to business banking setup, their expertise is unmatched. A special thanks to Scott for his incredible efficiency and professionalism. Highly recommend OpenHub for anyone looking to establish their business with ease!Posted onTrustindex verifies that the original source of the review is Google. Michael Columba Fletcher and his team have been invaluable and did a great job assisting me in getting my business registered and EID. I would highly recommend them to anyone having to go through this process.Posted onTrustindex verifies that the original source of the review is Google. Excellent service, everything was straight forward. Michael and the team were very responsive, making communication easy and putting my mind at ease with any concerns I had. Highly recommend.Posted onTrustindex verifies that the original source of the review is Google. I had Open Hub to help me with golden visa Because I had a flight back to Europe, I was in a hurry to get all done in couple days and Michael Fletcher promised it’s possible. And he and Open Hub delivered as promisedPosted onTrustindex verifies that the original source of the review is Google. Great experience with Michael recently, helping us set up our business in the UAE. Very smooth process and always on hand to answer any questions throughout. Definitely recommend for any British business owners looking to set up!Posted onTrustindex verifies that the original source of the review is Google. I received excellent service from Michael when setting up my business. He is very knowledgeable and keeps everything simple and easy to understand. Process was quick and efficent and he was always on hands to answer any questions. Would highly recommend to any of my friends or family.Posted onTrustindex verifies that the original source of the review is Google. Had a very good experience with Openhub. Very professional staff. Was able to get sound advise on my visa application and they were very adept at explaining the process. Execution and follow up was very timely and clear. No surprises at all and overall it was pleasant with absolutely no stress. A shout out and thanks to Michael Fletcher who handled my visa applicationPosted on

News

Some Pieces

of the Newsletter

250,000 New Companies and the Road to 2 Million by 2035

The UAE finished 2025 with a record-breaking economic performance. By adding 250,000 new companies...

Is Dubai Still Tax-Free in 2026? A Clear Guide for Business Owners

Dubai has long been synonymous with a tax-free lifestyle, serving as a global magnet for...

Trusts vs Foundations in the UAE – What You Should Know

If you are in the UAE and considering wealth preservation, estate planning, or long-term asset...