If you are in the UAE and considering wealth preservation, estate planning, or long-term asset holding, it is vital to understand the two main legal vehicles available in the financial free zones, which are commonly used as part of a freezone business setup in UAE: A Trust or a Foundation?.

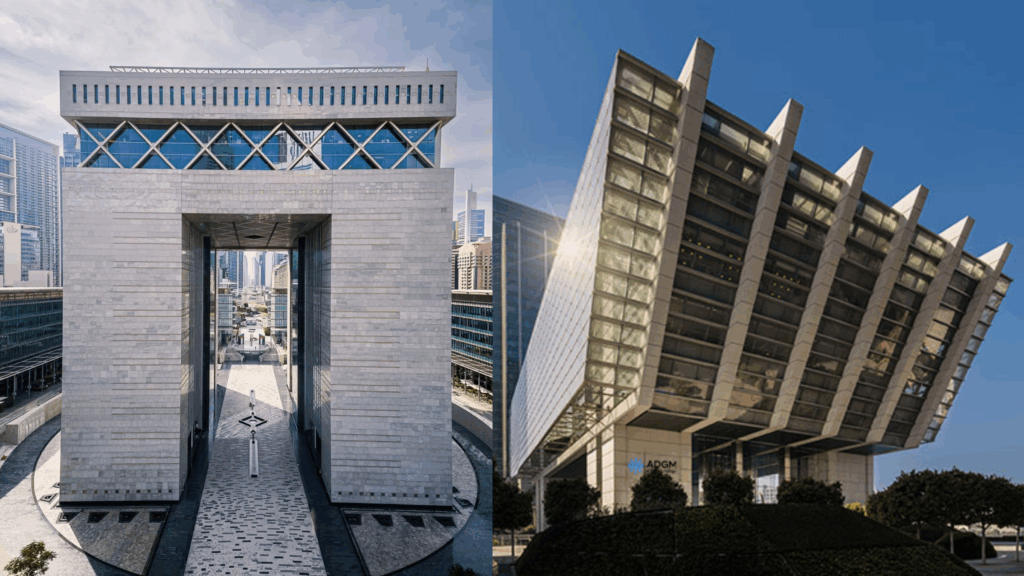

The UAE’s legal and regulatory environment, specifically within the Dubai International Financial Centre (DIFC), Abu Dhabi Global Market (ADGM), and RAK International Corporate Centre (RAK ICC), supports both, but their operation differs from traditional global structures.

Here is a straightforward breakdown for expats in the UAE and global investors.

The Foundation: A Separate Legal Personality

A Foundation in the UAE is a separate legal entity, much like a company, but without the shares or shareholders. It is often referred to as an “orphan structure.”

- Structure: It is governed by a Foundation Charter and By-Laws that define its purpose and rules. A Council manages the structure, and a Guardian can be appointed for oversight.

- Ownership & Protection: Because the Foundation is its own legal person, it holds assets (including UAE real estate and international portfolios) in its own name. This provides strong asset protection and shields them from the founder’s personal liabilities.

- Key Advantage: Foundations can exist indefinitely (perpetual existence), making them ideal for inter-generational planning, family business succession, and maintaining confidentiality (by-laws and beneficiaries are not publicly disclosed).

- Best For: Individuals and families seeking maximum control, long-term continuity, and a robust holding vehicle for their UAE and overseas assets.

The Trust: A Flexible Legal Relationship

A Trust is a legal arrangement or relationship, not a separate entity.

A Settlor transfers assets to a Trustee, who legally holds and manages them for the benefit of the Beneficiaries under a Trust Deed.

- Structure: Trusts are permitted under UK common law frameworks in jurisdictions like the DIFC and ADGM. The terms are fully customisable in the ‘Trust Deed’.

- Ownership & Management: The selected Trustee holds the legal title, and beneficiaries hold the beneficial interest.

- Key Advantage: Trusts are highly flexible, allowing for discretionary distributions. The Trustee can be empowered to decide how and when beneficiaries receive funds. This is useful for complex family needs or where circumstances may change.

- Best For: Clients requiring flexibility in distributions, independent professional asset management (by the Trustee), or those with complex, multi-jurisdictional estates that may align better with a UK common law trust framework.

Which Structure to Choose in the UAE?

Choosing between a trust or a foundation is often an early decision for investors planning to set up a company in the UAE as part of their long-term asset, tax, or estate planning strategy.

| Goal | Choose a Foundation | Choose a Trust |

| Control & Ownership | You want the structure to own the assets separately (strong shield). | You want a Trustee to legally own and manage the assets. |

| Long-Term Planning | Ideal for perpetuity (indefinite lifespan) and legacy. | May have a limited duration depending on the deed. |

| Discretion in Payouts | Lower discretion; rules are fixed in the Charter. | High discretion; Trustee decides timing and amount of distributions. |

| Tax Efficiency | Excellent, often zero tax on the entity level in free zones. | Tax treatment is complex; it depends on the residency of all parties. |

Important Practical Points

- Free Zones Only: Both foundations and trusts are only fully functional under common law in the DIFC, ADGM, and RAK ICC. They are not standard federal mainland structures.

- Tax and Residency: While UAE free zones offer favourable tax regimes, the overall tax implications depend heavily on the residency of the founder, beneficiaries, and trustees, especially concerning distributions across borders.

- Real Estate: Foundations are well-equipped to hold UAE real estate, but compliance with all local land-registration rules and free-zone agreements (MoUs) is mandatory.

- Expert Advice: Given the interplay between common law in the free zones and UAE civil law, always secure advice from a UAE-licensed legal and tax advisor.

For most families and entrepreneurs with significant UAE and international assets, the Foundation offers a compelling combination of control, stability, accessibility and confidentiality.

Our Managing Director, Nathan Gatland add’s: Historically, Foundations seem to be the preferred option in the UAE after our initial consultations and understanding the core objectives of our clients. Civil Law countries and jurisdictions such as the UAE (DIFC/ADGM) & Switzerland, where the concept of a Trust does not have many precedents to rely upon and are not always recognised by certain asset governing bodies. However with a Foundation being its own legal entity; documentation, issuance and on-going governance is a lot smoother, especially on the acquisitions and exit of assets.